A New Landscape for Innovation and Disruption

As we stand on the brink of an Artificial Intelligence (AI) driven revolution, we are witnessing a shift in the world of software: the declining cost to create products, services, and businesses. In the near-term, we believe some incumbents will maintain pricing power with the potential for margin expansion by incorporating AI into their operations, while others may fall victim to obsolescence. As the cost to create falls, so should the barriers to entry, stoking competition as new participants contend for greater market share at lower prices. Over the long-term, this deflationary shift may undermine the pricing power and margin structure of the incumbents, altering the software industry and redefining the terrain as the outlook remains in flux.

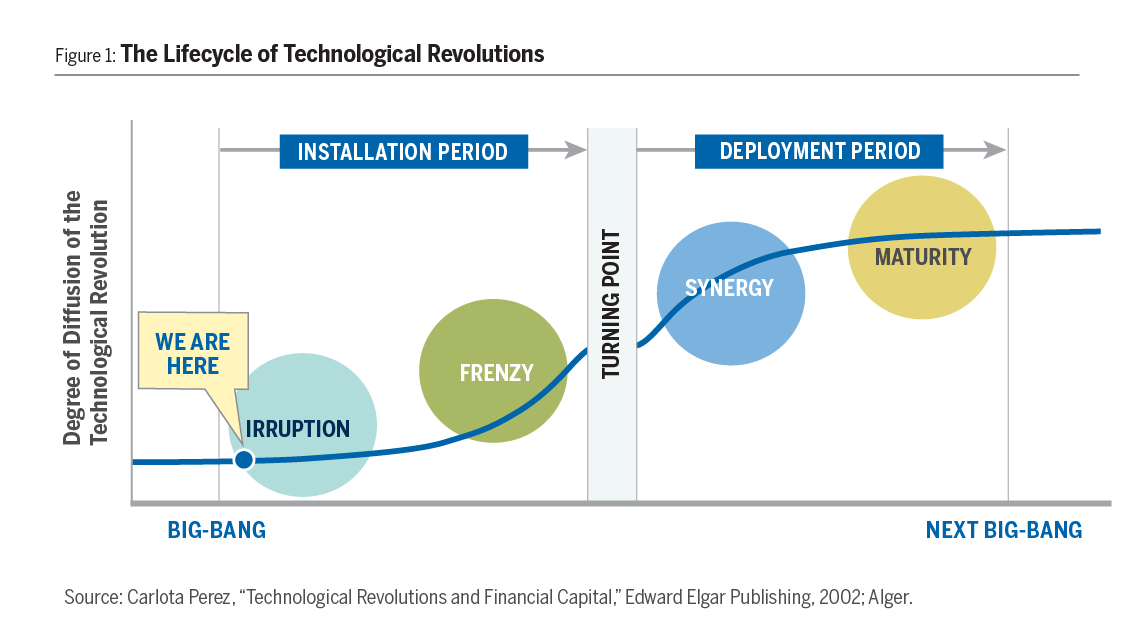

Technological revolutions, such as the invention of the internal combustion engine or the internet, do not merely change the landscape temporarily; they create a new terrain altogether. Historically, pioneering companies that drive this disruption accumulate market share over years, blossoming in this reshaped reality. Borrowing insights from Carlota Perez’s model, technological revolutions progress through five distinct stages roughly every half-century. We believe the advent of AI has the potential to be a technological revolution and could follow this model (see Figure 1):

-

Irruption: A disruptive innovation, such as AI, triggers the emergence of novel industries, rendering certain traditional ones obsolete.2 Investors seem to not heed the perennial disclosure that “past performance is not indicative of future performance.”

-

Frenzy: Financial markets become excessively optimistic about AI and similar technologies, causing a speculative bubble.

-

Turning Point: Often marked by a financial market downturn, this phase heralds the transition from a theoretical promise to widespread, practical implementation of AI.

-

Synergy: AI is deployed at scale, culminating in a ‘golden age’ where productivity and employment rates flourish, marking the zenith of the software revolution.

-

Maturity: Growth decelerates as the market becomes saturated with AI and its applications, signifying that AI has become the new norm.

Shrinking Time and Cost of Creation

Shrinking Time and Cost of CreationHistorically, within the software industry the ability to create apps, content, and businesses was limited by the time and skill of human developers. We are now entering a new era where AI can code (i.e., software acting as a developer and writing new software), which will significantly reduce the time and resources required to develop products. As the time and cost to create deteriorates, we see existing businesses and startups benefiting in different ways. For existing businesses, we believe AI integration allows businesses to become more efficient with fewer employees, thereby resulting in margin expansion. Below are a few examples since the November 2022 launch of ChatGPT

1:

- CEO of software company, Freshworks said, “software development that used to take anywhere from 8 to 10 weeks can be done in less than a week.”2

- A study done at MIT found that participants using Chat-GPT were able to complete tasks 37% faster with a slight improvement in quality.3

- CEO of Octopus Energy, a UK-based household energy supplier, said, “Emails written by AI delivered 80% customer satisfaction—comfortably better than the 65% achieved by skilled, trained people.”4

For new software businesses utilizing AI, the product development cycle has generally shrunk from years to months, effectively lowering the barriers to entry due to the declining time and cost of business creation. Through our research, we have found that startups have already begun leveraging AI-assisted coding tools to accelerate product development. Below are a few recent examples:

- Midjourney is a startup established in mid-2021 that utilizes AI to convert text into high-quality images. With a self-funded team of only 10 people, it rapidly attracted a user base of one million within just two months.5

-

Google Duplex—virtual assistant introduced in 2018 - was estimated to have taken several years to develop. However, Google Duplex was later recreated in just two hours by two developers using ChatGPT, demonstrating the efficiency of utilizing AI-powered solutions.6

A Shift Towards Value-Based Pricing

Generally, when the cost to create a business declines, the barriers to entry of that industry are lowered. This transformation levels the playing field for entrepreneurs, altering the landscape for incumbent businesses, as they must adapt. For software companies, conventional seat-based pricing, where price is determined by the number of individual users or ‘seats’, may no longer be effective. Consider an incumbent software company charging $25 per seat per month for an email marketing tool. With the cost-to-create being pulled lower, a smaller, nimbler competitor might create a better email marketing tool at a much lower price, undercutting the incumbent, yet still yielding a high return on investment, in our view.

As a result, this necessitates a shift in pricing strategies. As the potential for AI-enabled creation becomes increasingly available and the competitive landscape intensifies, software companies may need to pivot to a value-based pricing regime. This model prioritizes the value or utility that a customer derives from a product or service, instead of merely counting the number of users. This shift towards value could enable businesses to better reflect the true worth of their offerings and maintain profitability in the evolving landscape.

Generative AI Tearing Down Switching Costs Many businesses are built upon the deep integration of software solutions, entrapping clients with the daunting task of transferring countless files from one system to another—making switching costs a key pain point.

However, we believe generative AI tools may offer a glimpse into a future where ‘switching costs’ could decline. Generative AI can be thought of as an agent that helps smooth the data implementation process, enabling seamless connections between applications in a fraction of the time. Without the need for lengthy implementation processes and additional personnel, the competitive moat of high switching costs should potentially fall. As such, we believe the declining cost of implementation will require a long-term strategic shift for all software businesses.

Near-Term Winners and LosersAI is quickly becoming table stakes for certain businesses, creating winners and losers across various industries. We believe the near-term beneficiaries will be the companies adept at integrating AI into their offerings that can charge for additional functionality that increases productivity, resulting in improved operating margins. A software company may be able to incorporate a generative AI feature that improves user efficiency, allowing the company to increase the price of their product, resulting in margin expansion.

As more companies integrate AI into their business models, others may be caught in the crosshairs of this disruption. Specifically, we believe point solutions, which are companies that offer a standalone product or service, may soon be threatened with generative AI. For example, businesses that offer legal services may face severe cost pressures from nearcostless competitors. While entrusting AI in a high-stake legal case may be ill-advised, today, services like GPT4 may be able to draft better contracts than first year lawyers.

7 Instead of relying on a legal expert to start a small business, AI tools could facilitate the necessary documents and contracts at a fraction of the cost and potentially the time.

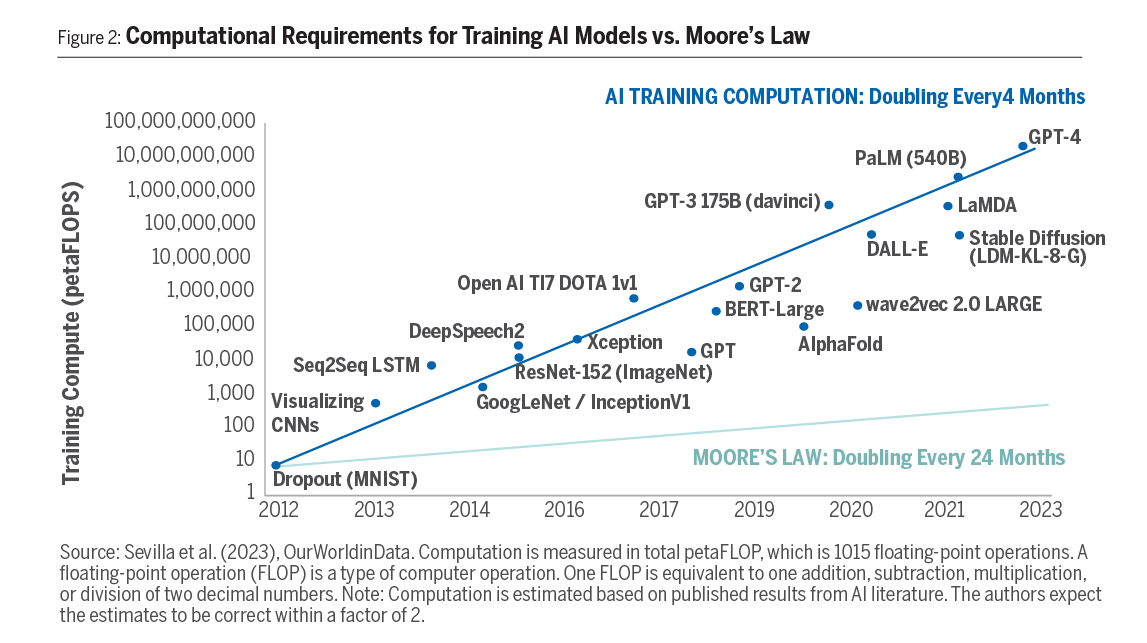

Semiconductors: The Most Obvious BeneficiaryNo matter who “wins” in the era of AI, demand for computing power will continue to rise, given the computational complexity required to run AI-related applications. The amount of “training” a computer program undergoes can be thought of as the computing usage (compute) to practice and improve a program’s skill. Compared to Moore’s Law, which states that the number of transistors on a microchip doubles approximately every two years, the rate of AI training (i.e., the number of computations an AI program can process) is seemingly doubling every four months (see Figure 2). As such, we believe semiconductor companies, which have evolved into effective oligopolies with increasing pricing power, will stand to benefit from supplying data centers that are becoming AI factories.

Unanswered Questions and the Path Forward As with any new technological innovation, the radical manner in which AI is permeating society leaves many unanswered questions. In our view, the world will undoubtedly look very different in a decade, with new businesses emerging and others becoming obsolete. As such, we believe margin structures may undergo dramatic shifts over the long term, as traditional revenue streams are disrupted and potentially replaced by innovative business models that are deflationary. There are some well entrenched businesses that will be net beneficiaries as they incorporate more efficient functionality and reap the margin benefits. However, others will be faced with an entirely new competitive environment where margins will be at risk.

As we navigate the uncharted waters of declining costs for creation and implementation, we foresee a re-imagining of business models, potentially unlocking new pathways for creativity and innovation, transforming the way we work and collaborate. At Alger, we are excited to embrace the potential investment opportunities ahead, as we remain vigilant in the coming revolution.