With trade policy details still evolving, how might these measures affect corporate earnings, and how might investors potentially mitigate tariff exposure?

Investors have been closely monitoring recent developments in U.S. trade policy, as President Donald Trump has discussed implementing reciprocal tariffs. These proposed tariffs aim to address international trade imbalances by targeting what are deemed “unfair trade practices,” particularly instances where U.S. exports are subject to higher tariffs abroad than the U.S. imposes on imports from its trading partners. While details have yet to take shape, some areas of the global economy and equity markets are likely to be more affected than others.

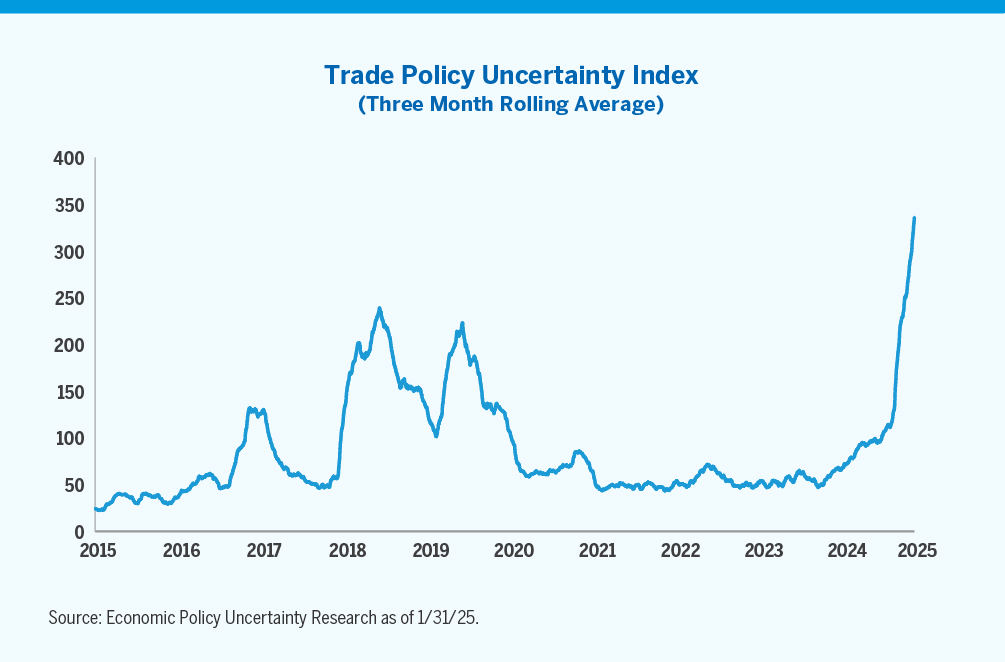

- President Trump has long criticized U.S. trade policy. His election and subsequent policy announcements have led to an increase in the Trade Policy Uncertainty Index shown above, which measures the frequency of articles discussing trade policy and uncertainty in major newspapers, reflecting the level of uncertainty in trade policies.

- A recent White House policy memorandum on reciprocal tariffs seeks to match foreign taxes on U.S. goods with new U.S. import duties.1 If enacted, these measures could lead to higher tariffs on U.S. imports from major trade partners, which currently impose significantly higher tariffs on U.S. exports than the U.S. charges on their imports. Moreover, if Value Added Taxes (VATs) are included, as President Trump has suggested, countries such as Canada, Mexico, Germany, and India—each of which levy VATs between 5% and 28%—could be particularly affected.

- While it is difficult to predict the exact impact on corporate earnings, the potential effects on U.S. companies could vary. For example, an analysis of trailing twelve-month revenues shows that 41% of S&P 500 revenues were generated outside the U.S., compared to 27% for the Russell Midcap and 23% for the Russell 2000, implying small and mid-cap stocks may be better positioned to withstand trade policy changes.2

1White House, Fact Sheet – President Donald J. Trump Announces Fair and Reciprocal Plan on Trade, February 13, 2025.

2FactSet Geographic Revenue as of 12/31/24.

The views expressed are the views of Fred Alger Management, LLC (“FAM”) and its affiliates as of February 2025. These views are subject to change at any time and may not represent the views of all portfolio management teams. These views should not be interpreted as a guarantee of the future performance of the markets, any security or any funds managed by FAM. These views are not meant to provide investment advice and should not be considered a recommendation to purchase or sell securities.

Risk Disclosures: Investing in the stock market involves risks, including the potential loss of principal. Growth stocks may be more volatile than other stocks as their prices tend to be higher in relation to their companies’ earnings and may be more sensitive to market, political, and economic developments.

Past performance is not indicative of future performance. Investors whose reference currency differs from that in which the underlying assets are invested may be subject to exchange rate movements that alter the value of their investments.

Companies involved in, or exposed to, AI-related businesses may have limited product lines, markets, financial resources or personnel as they face intense competition and potentially rapid product obsolescence, and many depend significantly on retaining and growing their consumer base. These companies may be substantially exposed to the market and business risks of other industries or sectors, and may be adversely affected by negative developments impacting those companies, industries or sectors, as well as by loss or impairment of intellectual property rights or misappropriation of their technology. Companies that utilize AI could face reputational harm, competitive harm, and legal liability, and/or an adverse effect on business operations as content, analyses, or recommendations that AI applications produce may be deficient, inaccurate, biased, misleading or incomplete, may lead to errors, and may be used in negligent or criminal ways. AI companies, especially smaller companies, tend to be more volatile than companies that do not rely heavily on technology.

Important Information for US Investors: This material must be accompanied by the most recent fund fact sheet(s) if used in connection with the sale of mutual fund and ETF shares. Fred Alger & Company, LLC serves as distributor of the Alger mutual funds.

Important Information for UK and EU Investors: This material is directed at investment professionals and qualified investors (as defined by MiFID/FCA regulations). It is for information purposes only and has been prepared and is made available for the benefit investors. This material does not constitute an offer or solicitation to any person in any jurisdiction in which it is not authorized or permitted, or to anyone who would be an unlawful recipient, and is only intended for use by original recipients and addressees. The original recipient is solely responsible for any actions in further distributing this material and should be satisfied in doing so that there is no breach of local legislation or regulation. Certain products may be subject to restrictions with regard to certain persons or in certain countries under national regulations applicable to such persons or countries.

Alger Management, Ltd. (company house number 8634056, domiciled at 85 Gresham Street, Suite 308, London EC2V 7NQ, UK) is authorised and regulated by the Financial Conduct Authority, for the distribution of regulated financial products and services. FAM, Weatherbie Capital, LLC, and/or Redwood Investments, LLC, U.S. registered investment advisors, serve as sub-portfolio manager to financial products distributed by Alger Management, Ltd.

Alger Group Holdings, LLC (parent company of FAM and Alger Management, Ltd.), FAM, and Fred Alger & Company, LLC are not authorized persons for the purposes of the Financial Services and Markets Act 2000 of the United Kingdom (“FSMA”) and this material has not been approved by an authorized person for the purposes of Section 21(2)(b) of the FSMA.

Important information for Investors in Israel: Fred Alger Management, LLC is neither licensed nor insured under the Israeli Regulation of Investment Advice, of Investment Marketing, and of Portfolio Management Law, 1995 (the "Investment Advice Law"). This document is for information purposes only and should not be construed as an offering of Investment Advisory, Investment Marketing or Portfolio Management services (As defined in the Investment Advice Law). Services regulated under the Investment Advice Law are only available to investors that fall within the First Schedule of Investment Advice Law ("Qualified Clients"). It is hereby noted that with respect to Qualified Clients, Fred Alger Management, LLC is not obliged to comply with the following requirements of the Investment Advice Law: (1) ensuring the compatibility of service to the needs of client; (2) engaging in a written agreement with the client, the content of which is as described in section 13 of the Investment Advice Law; (3) providing the client with appropriate disclosure regarding all matters that are material to a proposed transaction or to the advice given; (4) a prohibition on preferring certain Securities or other Financial Assets; (5) providing disclosure about "extraordinary risks" entailed in a transaction (and obtaining the client's approval of such transactions, if applicable); (6) a prohibition on making Portfolio Management fees conditional upon profits or number of transactions; (7) maintaining records of advisory/discretionary actions. This document is directed at and intended for Qualified Clients only.

The S&P 500 Index is an unmanaged index considered representative of the U.S. stock market without regard to company size. The S&P indexes are a product of S&P Dow Jones Indices LLC and/or its affiliates and has been licensed for use by Fred Alger Management, LLC and its affiliates. Copyright 2025 S&P Dow Jones Indices LLC, a subsidiary of S&P Global Inc. and/or its affiliates. All rights reserved. Redistribution or reproduction in whole or in part are prohibited without written permission of S&P Dow Jones Indices LLC. S&P® is a registered trademark of Standard & Poor’s Financial Services LLC and Dow Jones® is a registered trademark of Dow Jones Trademark Holdings LLC. Neither S&P Dow Jones Indices LLC, Dow Jones Trademark Holdings LLC, their affiliates nor their third party licensors make any representation or warranty, express or implied, as to the ability of any index to accurately represent the asset class or market sector that it purports to represent and neither S&P Dow Jones Indices LLC, Dow Jones Trademark Holdings LLC, their affiliates nor their third party licensors shall have any liability for any errors, omissions, or interruptions of any index or the data included therein. Investors cannot invest directly in any index. Index performance does not reflect deductions for taxes.

The performance data quoted represents past performance, which is not an indication or a guarantee of future results.

The Russell 2000® Index measures the performance of the small-cap segment of the U.S. equity universe. The Russell 2000 Index is constructed to provide a comprehensive and unbiased barometer for the small-cap segment. The Russell Midcap Index measures the performance of the mid-cap segment of the US equity universe. The Russell Midcap Index is a subset of the Russell 1000 Index. It includes approximately 800 of the smallest securities based on a combination of their market cap and current index membership. The Russell Midcap Index represents approximately 27% of the total market capitalization of the Russell 1000 companies, as of the most recent reconstitution. The Russell Midcap Index is constructed to provide a comprehensive and unbiased barometer for the mid-cap segment. The index is completely reconstituted annually to ensure larger stocks do not distort the performance and characteristics of the true midcap opportunity set. Investors cannot invest directly in any index. Index performance does not reflect deductions for taxes.

The performance data quoted represents past performance, which is not an indication or a guarantee of future results.

London Stock Exchange Group plc and its group undertakings (collectively, the “LSE Group”). © LSE Group 2025. FTSE Russell is a trading name of certain of the LSE Group companies. “FTSE®” “Russell®”, “FTSE Russell®”, “FTSE4Good®”, “ICB®”, “Mergent®, The Yield Book®,” are trade marks of the relevant LSE Group companies and are used by any other LSE Group company under license. All rights in the FTSE Russell indexes or data vest in the relevant LSE Group company which owns the index or the data. Neither LSE Group nor its licensors accept any liability for any errors or omissions in the indexes or data and no party may rely on any indexes or data contained in this communication. No further distribution of data from the LSE Group is permitted without the relevant LSE Group company’s express written consent. The LSE Group does not promote, sponsor or endorse the content of this communication.

The Trade Policy Uncertainty (TPU) index is based on automated text searches of the electronic archives of seven newspapers: Boston Globe, Chicago Tribune, Guardian, Los Angeles Times, New York Times, Wall Street Journal, and Washington Post. The measure is calculated by counting the monthly frequency of articles discussing trade policy uncertainty (as a share of the total number of news articles) for each newspaper. The index is then normalized to a value of 100 for a one percent article share.

FactSet is an independent source, which Alger believes to be a reliable source. FAM, however, makes no representation that it is complete or accurate.

Alger pays compensation to third party marketers to sell various strategies to prospective investors.

Fred Alger Management, LLC 100 Pearl Street, New York, NY, 10004 / www.alger.com / 212.806.8800