Scaling Up Intelligence

Artificial intelligence models are advancing at an unprecedented rate. But what exactly does their training involve, and will it continue to boost their capabilities?

Artificial intelligence (AI) models are progressing at an unprecedented pace (see

Beyond Moore’s Law), fueled by advancements in training techniques, as well as massive datasets and computational scaling. Yet what exactly does AI training involve, and will it continue to elevate their capabilities?

- Much like a runner preparing for a marathon, AI models undergo intensive training involving supervised and unsupervised learning. Unsupervised learning enables models to independently discover patterns and relationships in unlabeled data, while supervised learning aids models with labeled data to achieve specific outcomes (e.g., email spam filters). For this training to occur, an enormous amount of data is processed using networked GPUs to generate trillions of parameters that help models interpret and generate content.

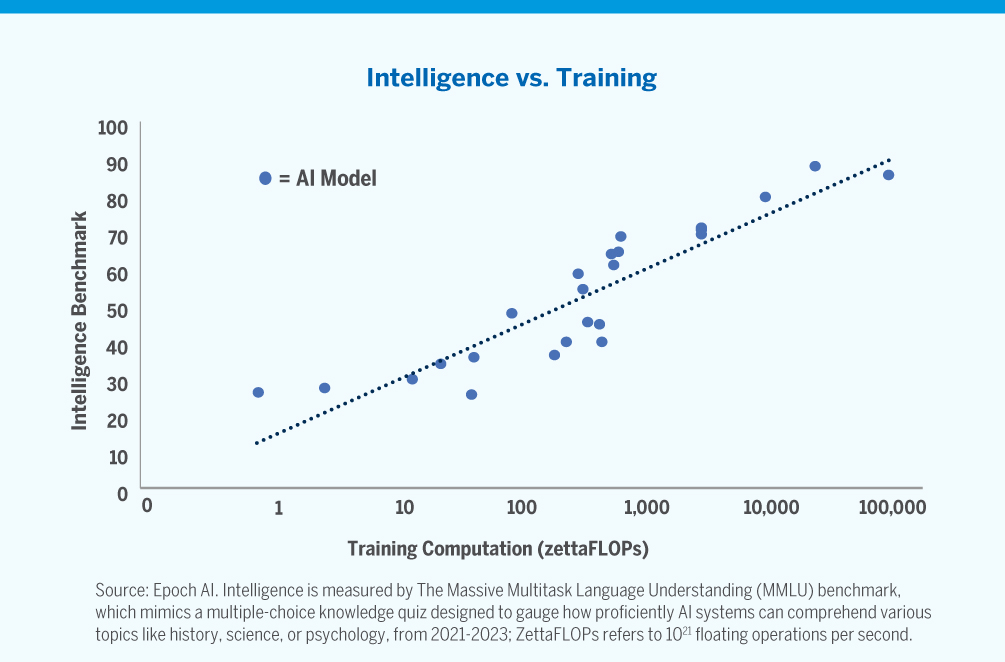

- Historically, there has been a positive correlation between AI intelligence and training computation, as shown in the chart above. This empirical relationship is sometimes referred to as AI “scaling laws.” Given that AI models are likely to be trained on larger datasets with more computational power over the next couple of years, we believe that if these scaling “laws” hold, these models will become much smarter. In fact, Nvidia CEO Jensen Huang recently said that “foundation model pre-training scaling is intact and it’s continuing” and went on to mention that AI post-training scaling is also helping AI models become smarter.1

- As AI models become more capable, we believe their usefulness to companies and individuals will grow, providing a better return on investment for those adopting AI solutions. In our view, this could benefit not only the AI adopters but also the providers of the necessary infrastructure –the AI enablers.

1 Nvidia, Corp. 3Q 2024 Earnings Call.

The views expressed are the views of Fred Alger Management, LLC (“FAM”) and its affiliates as of December 2024. These views are subject to change at any time and may not represent the views of all portfolio management teams. These views should not be interpreted as a guarantee of the future performance of the markets, any security or any funds managed by FAM. These views are not meant to provide investment advice and should not be considered a recommendation to purchase or sell securities.

Risk Disclosures: Investing in the stock market involves risks, including the potential loss of principal. Growth stocks may be more volatile than other stocks as their prices tend to be higher in relation to their companies’ earnings and may be more sensitive to market, political, and economic developments. Local, regional or global events such as environmental or natural disasters, war, terrorism, pandemics, outbreaks of infectious diseases and similar public health threats, recessions, or other events could have a significant impact on investments.

Past performance is not indicative of future performance. Investors whose reference currency differs from that in which the underlying assets are invested may be subject to exchange rate movements that alter the value of their investments.

Companies involved in, or exposed to, AI-related businesses may have limited product lines, markets, financial resources or personnel as they face intense competition and potentially rapid product obsolescence, and many depend significantly on retaining and growing their consumer base. These companies may be substantially exposed to the market and business risks of other industries or sectors, and may be adversely affected by negative developments impacting those companies, industries or sectors, as well as by loss or impairment of intellectual property rights or misappropriation of their technology. Companies that utilize AI could face reputational harm, competitive harm, and legal liability, and/or an adverse effect on business operations as content, analyses, or recommendations that AI applications produce may be deficient, inaccurate, biased, misleading or incomplete, may lead to errors, and may be used in negligent or criminal ways. AI companies, especially smaller companies, tend to be more volatile than companies that do not rely heavily on technology.

Important Information for US Investors: This material must be accompanied by the most recent fund fact sheet(s) if used in connection with the sale of mutual fund and ETF shares. Fred Alger & Company, LLC serves as distributor of the Alger mutual funds.

Important Information for UK and EU Investors: This material is directed at investment professionals and qualified investors (as defined by MiFID/FCA regulations). It is for information purposes only and has been prepared and is made available for the benefit investors. This material does not constitute an offer or solicitation to any person in any jurisdiction in which it is not authorized or permitted, or to anyone who would be an unlawful recipient, and is only intended for use by original recipients and addressees. The original recipient is solely responsible for any actions in further distributing this material and should be satisfied in doing so that there is no breach of local legislation or regulation.

Certain products may be subject to restrictions with regard to certain persons or in certain countries under national regulations applicable to such persons or countries.

Alger Management, Ltd. (company house number 8634056, domiciled at 85 Gresham Street, Suite 308, London EC2V 7NQ, UK) is authorised and regulated by the Financial Conduct Authority, for the distribution of regulated financial products and services. FAM, Weatherbie Capital, LLC, and/or Redwood Investments, LLC, U.S. registered investment advisors, serve as sub-portfolio manager to financial products distributed by Alger Management, Ltd.

Alger Group Holdings, LLC (parent company of FAM and Alger Management, Ltd.), FAM, and Fred Alger & Company, LLC are not authorized persons for the purposes of the Financial Services and Markets Act 2000 of the United Kingdom (“FSMA”) and this material has not been approved by an authorized person for the purposes of Section 21(2)(b) of the FSMA.

Important information for Investors in Israel: Fred Alger Management, LLC is neither licensed nor insured under the Israeli Regulation of Investment Advice, of Investment Marketing, and of Portfolio Management Law, 1995 (the "Investment Advice Law"). This document is for information purposes only and should not be construed as an offering of Investment Advisory, Investment Marketing or Portfolio Management services (As defined in the Investment Advice Law). Services regulated under the Investment Advice Law are only available to investors that fall within the First Schedule of Investment Advice Law ("Qualified Clients"). It is hereby noted that with respect to Qualified Clients, Fred Alger Management, LLC is not obliged to comply with the following requirements of the Investment Advice Law: (1) ensuring the compatibility of service to the needs of client; (2) engaging in a written agreement with the client, the content of which is as described in section 13 of the Investment Advice Law; (3) providing the client with appropriate disclosure regarding all matters that are material to a proposed transaction or to the advice given; (4) a prohibition on preferring certain Securities or other Financial Assets; (5) providing disclosure about "extraordinary risks" entailed in a transaction (and obtaining the client's approval of such transactions, if applicable); (6) a prohibition on making Portfolio Management fees conditional upon profits or number of transactions; (7) maintaining records of advisory/discretionary actions. This document is directed at and intended for Qualified Clients only.

Epoch AI is a research-focused organization that investigates the trajectory, impact, and governance of artificial intelligence (AI). It analyzes trends in machine learning, AI automation, and related economic factors, providing data-driven insights and tools to inform policymakers and stakeholders about the future of AI development. The company also publishes research and offers interactive models to foster informed discussions about AI's societal implications.

The following positions represent firm wide assets under management as of September 30, 2024: Nvidia Corp., 8.5%.

Alger pays compensation to third party marketers to sell various strategies to prospective investors.

Fred Alger Management, LLC 100 Pearl Street, New York, NY, 10004 / 212.806.8800 / www.alger.com