The AI Investment Paradox

Over the past few weeks, concerns have emerged that increasingly efficient AI training techniques may reduce spending on the hardware needed to train AI models. Could this signal a slowdown in capital investments in AI infrastructure?

Recently, there has been concern that artificial intelligence (AI) software is becoming significantly more efficient and may reduce spending on related hardware used to train AI models. While cheaper AI training may benefit

AI adopters, does this signal a slowdown in capital investments in

AI enablers? Or could it create new opportunities for both AI

enablers and

adopters?

- AI training involves teaching a model with large datasets to identify patterns—similar to studying for an exam. For training to occur, an enormous amount of data is processed using networked GPUs to generate trillions of parameters that help models interpret and generate content. Inference, on the other hand, is when the trained model makes predictions or decisions, requiring speed and real-time capabilities for applications like autonomous driving, fraud detection, and robotic process automation.

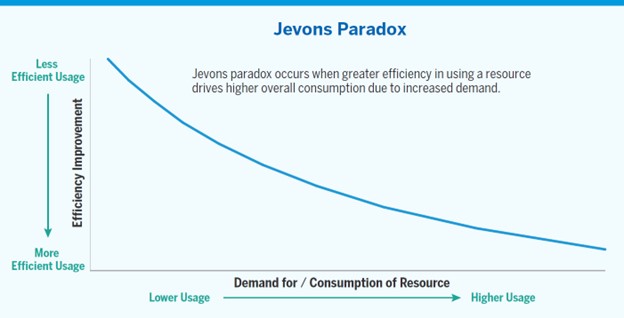

- While the cost of training AI models may fall due to innovative techniques, we believe this may be encouraging for both AI enablers and adopters over the long-term thanks to a phenomenon called Jevons paradox. The concept, shown in the chart above, states that as resource usage efficiency improves, demand for that resource often increases, leading to higher overall consumption. For example, during the Industrial Revolution, steam engines became more efficient and consumed less coal per unit of power; however, these efficiency gains stimulated widespread industrial growth, which ultimately increased aggregate coal consumption. Jevons paradox demonstrates that efficiency gains can have unintended consequences, spurring increased utilization of the very resources they are meant to conserve.

- As the cost of AI training falls, we believe the development cycle for improved models may accelerate, potentially increasing the pace of AI adoption, which in turn may lead to an acceleration in inferencing (see Alger Breaking Views - DeepSeek). Accordingly, we believe that much of the value in AI workloads may shift from training to inference as consumers and enterprises utilize more AI applications. While training will still be a significant part of AI workloads, particularly for proprietary data, we believe this shift necessitates scalable network infrastructure for handling real-time data streams, and efficient cooling and power systems to sustain data center performance.

The views expressed are the views of Fred Alger Management, LLC (“FAM”) and its affiliates as of February 2025. These views are subject to change at any time and may not represent the views of all portfolio management teams. These views should not be interpreted as a guarantee of the future performance of the markets, any security or any funds managed by FAM. These views are not meant to provide investment advice and should not be considered a recommendation to purchase or sell securities.

Risk Disclosures: Investing in the stock market involves risks, including the potential loss of principal. Growth stocks may be more volatile than other stocks as their prices tend to be higher in relation to their companies’ earnings and may be more sensitive to market, political, and economic developments.

Past performance is not indicative of future performance. Investors whose reference currency differs from that in which the underlying assets are invested may be subject to exchange rate movements that alter the value of their investments.

Companies involved in, or exposed to, AI-related businesses may have limited product lines, markets, financial resources or personnel as they face intense competition and potentially rapid product obsolescence, and many depend significantly on retaining and growing their consumer base. These companies may be substantially exposed to the market and business risks of other industries or sectors, and may be adversely affected by negative developments impacting those companies, industries or sectors, as well as by loss or impairment of intellectual property rights or misappropriation of their technology. Companies that utilize AI could face reputational harm, competitive harm, and legal liability, and/or an adverse effect on business operations as content, analyses, or recommendations that AI applications produce may be deficient, inaccurate, biased, misleading or incomplete, may lead to errors, and may be used in negligent or criminal ways. AI companies, especially smaller companies, tend to be more volatile than companies that do not rely heavily on technology. Investing in innovation is not without risk and there is no guarantee that investments in research and development will result in a company gaining market share or achieving enhanced revenue. Companies exploring new technologies may face regulatory, political or legal challenges that may adversely impact their competitive positioning and financial prospects. Developing technologies to displace older technologies or create new markets may not in fact do so, and there may be sector-specific risks. There will be winners and losers that emerge, and investors need to conduct a significant amount of due diligence on individual companies to assess these risks and opportunities.

Important Information for US Investors: This material must be accompanied by the most recent fund fact sheet(s) if used in connection with the sale of mutual fund and ETF shares. Fred Alger & Company, LLC serves as distributor of the Alger mutual funds.

Important Information for UK and EU Investors: This material is directed at investment professionals and qualified investors (as defined by MiFID/FCA regulations). It is for information purposes only and has been prepared and is made available for the benefit investors. This material does not constitute an offer or solicitation to any person in any jurisdiction in which it is not authorized or permitted, or to anyone who would be an unlawful recipient, and is only intended for use by original recipients and addressees. The original recipient is solely responsible for any actions in further distributing this material and should be satisfied in doing so that there is no breach of local legislation or regulation.

Certain products may be subject to restrictions with regard to certain persons or in certain countries under national regulations applicable to such persons or countries.

Alger Management, Ltd. (company house number 8634056, domiciled at 85 Gresham Street, Suite 308, London EC2V 7NQ, UK) is authorised and regulated by the Financial Conduct Authority, for the distribution of regulated financial products and services. FAM, Weatherbie Capital, LLC, and/or Redwood Investments, LLC, U.S. registered investment advisors, serve as sub-portfolio manager to financial products distributed by Alger Management, Ltd.

Alger Group Holdings, LLC (parent company of FAM and Alger Management, Ltd.), FAM, and Fred Alger & Company, LLC are not authorized persons for the purposes of the Financial Services and Markets Act 2000 of the United Kingdom (“FSMA”) and this material has not been approved by an authorized person for the purposes of Section 21(2)(b) of the FSMA.

Important information for Investors in Israel: Fred Alger Management, LLC is neither licensed nor insured under the Israeli Regulation of Investment Advice, of Investment Marketing, and of Portfolio Management Law, 1995 (the "Investment Advice Law"). This document is for information purposes only and should not be construed as an offering of Investment Advisory, Investment Marketing or Portfolio Management services (As defined in the Investment Advice Law). Services regulated under the Investment Advice Law are only available to investors that fall within the First Schedule of Investment Advice Law ("Qualified Clients"). It is hereby noted that with respect to Qualified Clients, Fred Alger Management, LLC is not obliged to comply with the following requirements of the Investment Advice Law: (1) ensuring the compatibility of service to the needs of client; (2) engaging in a written agreement with the client, the content of which is as described in section 13 of the Investment Advice Law; (3) providing the client with appropriate disclosure regarding all matters that are material to a proposed transaction or to the advice given; (4) a prohibition on preferring certain Securities or other Financial Assets; (5) providing disclosure about "extraordinary risks" entailed in a transaction (and obtaining the client's approval of such transactions, if applicable); (6) a prohibition on making Portfolio Management fees conditional upon profits or number of transactions; (7) maintaining records of advisory/discretionary actions. This document is directed at and intended for Qualified Clients only.

The following positions represent firm wide assets under management as of November 30, 2024: DeepSeek, 0.0%.

Alger pays compensation to third party marketers to sell various strategies to prospective investors.